Security of supply is one of the most critical priorities of any supply chain; cost and compliance are the other top ones. Given how critical security of supply is, I am often surprised by how inadequate many due diligence programs are at getting to the heart of risk or ensuring that adequate agility exists to meet user needs.

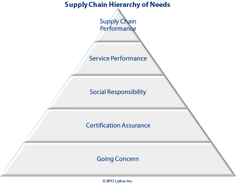

The problem of ensuring adequate security of supply parallels behavior motivation as expressed in Maslow’s hierarchy of needs. In Maslow’s model, the base layer holds the physiological (or survival) needs and the top contains the self-actualization needs for achieving individual potential. While the analogy may not be exact, it does offer a structure for considering how one might improve supply risk management.

A security of supply pyramid would be structured like the model shown at right. Maslow’s self-actualization is replaced by supply chain performance where a well-designed and tuned supply chain performs at the highest level. The physiological needs become concerns about the viability of a company or supplier. As with Maslow’s model, lower layer needs must be satisfied before you can ascend to higher levels.

The tough questions

Within this new construct, questions that target the core of risk concern can be directed at suppliers (manufacturers, distributors, ODM, EMS, Foundry, etc.). In this series of blogs I will examine each layer of the pyramid, starting with what I refer to as Going Concern, to illustrate how due diligence can be improved.

Going Concern refers to a company’s ability to exist — to fund its operation and keep going. Failure to fund the operation occurs when a company runs out of cash; without cash it cannot pay its bills, its suppliers, its employees, or anything else. Running out of cash does not mean losing money. Companies can sustain losses for a long time provided they have a good cash balance or can raise cash through debt or equity financing. Most companies burning through cash don’t actually run dry; instead, they file for chapter 11 bankruptcy protection. This enables them to shed debt, restructure, and emerge in some new form either as an operating entity, an acquired entity, or as assets for sale. None of these options are desirable in one of your supply chain participants.

How can you tell whether a company is running out of cash and has limited access to new funding? This is difficult with publicly traded companies and harder still with privately held firms.

Most companies attempt to assess a supplier by gaining access to financial information. The SEC 10-K and 10-Q reports provide good information on public companies, but private ones often hold financial information close to the chest. One could argue that if a company gives financial information to a bank in order to secure a loan, it should be willing to share the information with a customer to secure an order.

This sounds reasonable, but companies are reluctant to share this degree of detail. Keep in mind that financial information may not be the best predictor of failure; even with the financial numbers you need to know what you’re looking for in your analysis.

Details, details

Dunn & Bradstreet report that the best indicator of a company’s potential failure is its operational performance. Companies with poor operational performance are probably not winning new orders and are most likely cutting back on expenses, making the service performance worse. This indicates that it is imperative to track operational service levels of current suppliers and, in the case of new suppliers, question references on service levels.

It’s hard not to want some kind of financial analysis, so there are things to look at, which suppliers — private or public — should be willing to share. Here is the shortlist:

- Auditor’s Report: In their annual report, auditors must include any concerns they have about a company as an ongoing entity. The absence of such a statement in this report is a positive sign about a company’s health. Auditor’s reports do not reveal any information about the company’s financials, so if there is no Going Concern issue, the company should be willing to share it.

- Cost of Debt: Interest rates are set based on risk. If you can compare a company’s bond or loan interest to the average rate at the time the debt transaction occurred, you will get a feeling for the degree of risk.

- Credit Scores: Credit scores are an indicator of risk.

- Press Releases: Press releases showing a change in management, financing, or ownership should be examined for root cause and can often signal underlying problems.

- Financial Metrics and Ratios: Quick ratio, current ratio, and debt to equity are good at highlighting possible problems. EBITDA and cash generated from operations measured over 4 to 8 quarters are telling; they should be positive most of the time. High levels of Goodwill should be a cause for concern. Rerun any financial analysis with goodwill set to zero and see if the company remains healthy. Have your accounting group identify a list of financial parameters and acceptable target levels for you to operate with.

If a company fails to satisfy you on any shortlist items, ask it for an explanation to alleviate your concerns. If it is not forthcoming with a good explanation, move on to other supply options.

In part 2 of this series I will continue my examination of the layers in the Lytica Supply Chain Hierarchy of Needs.

By Ken Bradley – Lytica Inc. Founder/Chairman/CTO